Saving Money

Personal Budgeting Made Simple

What is a budget? At a high level it takes your expected income and details out where that money goes. Your first step to creating a personal budget is to gather your financial data. I use excel since I am most familiar with that from work but google sheets is free and works just as well.

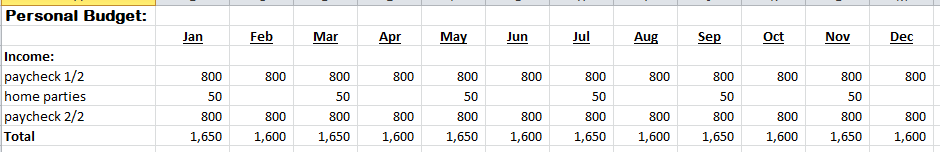

Your income consists of any money you have coming in. This can be a paycheck, child support, annuity or anything else you get on a regular basis that you can rely on. In the example below the person gets paid 2X a month and has a home party business on the side. For the party business income isn’t regular but at a minimum she has been making $50 every other month. If you get paid weekly Assume 4 paychecks in a month, bi-weekly assume 2 per month. (We will discuss those “extra” checks later for those paid bi-weekly)

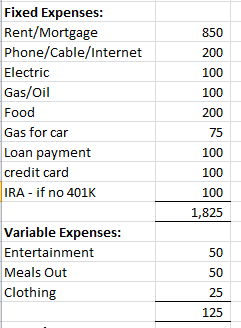

Now it is time to talk about your expenses. You have fixed expenses which are items that you have to pay no matter what like rent, food, loan payments, and utilities. Then you have variable expenses which like it imply the cost varies from month to month and could be skipped all together if you had to like eating out and entertainment.

Your fixed expenses should include all the things you can’t not pay which is why they are “fixed” I’ve given some examples but you may have additional items like condo fees or property taxes to consider. It may take a month or so to fine tune everything and make sure you have all the big things covered. Like your quarterly trash pick-up bill. Don’t forget things like credit card payments and gas for your car if you commute. If you have a 401k at work which is already deducted from your check then additional retirement money if you choose to do that could be a variable expense since you are already paying for that 401k off the top of your check.

Your variable expenses are just that – things that you can essentially do without if needed like entertainment and meals out also extras like hair and nail appointments. I am not saying these should be avoided just that you pay the first category off before you do these things.

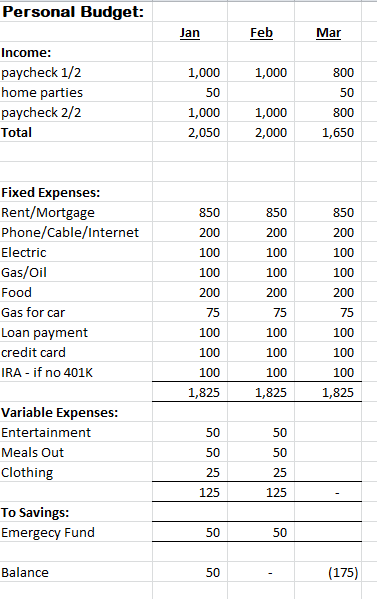

In this example this person made more money in Jan and Feb – perhaps extra hours, second job or overtime. You can see in March when this goes away there is now not enough cash to cover basic expenses even when all variable expenses and emergency savings are removed. This is a common pitfall people fall into the start to rely on that income. Then when it is gone you are in serious trouble.

If you are paid bi-weekly (every other week) read this if not just skip this paragraph. This means that twice a year you get 3 paychecks in a month vs 2. I recommend you set your budget up for 2 checks a month and then on those months you get the extra check you set that money aside into an emergency fund or special goal if you have an emergency fund.

Many people live paycheck to paycheck with no emergency fund and then have to rely on a credit card should an emergency arise. Your goal through this budget should be to create an emergency fund that you only touch if you really need it. Keep it separate, if need be in a different bank to keep temptation down. Realistically you should have enough to cover at minimum 3 months of bills, 6 months is ideal. How much was that last car repair you did? Or plumber bill? Bad things happen at the worst times. Things happen you don’t expect that’s why they are called emergencies or accidents. Better to plan for that now.

This latest Coronavirus emergency has taught us to have a few weeks of food and basic supplies on hand and what can happen when you don’t. The shelves are empty…..

I’d love to hear your questions and I can add information to this article based on your questions. Feel free to email them to support@smarterselfhelp.com.

Saving Money

10 Ways to Simplify your Finances by Decluttering

Money can be a real source of stress for most people. No one likes to take time out to pay bills, especially if funds are tight, but it is a definite must to in our current way of life. Not taking care of your finances can lead to bad credit which can cost you more in interest rates when you need to make a big purchase or deny you all together.

There are a few things you can do to make this process easier, less painful and more organized. These are keeping it simple ways to declutter your finances and make your life easier. If you don’t pay your bills on time normally this can help you get on the right track.

- The first step is to know where your money goes. This sound easier than you think. Many small and cash purchases don’t get tracked and can be forgotten. So for a month or two keep track of what you spend your money on either on paper or electronically.

- Once you have completed step 1 – create a monthly budget. This will detail your current income and bills. If you have never created a budget we will be doing an article on Budgeting 101 soon and once it is done I will add a link here. (see Budgeting Made Simple)

- Auto pay any bills you can to one credit card. I have one that I use to get points, just be sure it is a card you pay off monthly with no exceptions. The point of this is to make it simple not pay for interest. I set this card to auto pay on the date from my bank account. This works for things like gas, some utilities, phone and subscriptions.

- Pay on-line. I am still amazed by the people who write and mail checks. No more waiting to be sure your payment arrives and the cost of stamps is only going up. Most on-line banking will give you a traceable confirmation number.

- Use your bank’s bill paying function to pay bills that don’t fit into item 3 or 4. Auto draft is also available (sometime mandatory) for mortgage, personal loan and car payments.

- Still get bills in the mail? Or email notifications? Then the day you get them set them up for payment on the due date. Don’t wait only to find them in a drawer weeks from now, or buried at the bottom of emails you forgot about. I signed up for electronic bills in my banks bill payer system so I get the bill electronically right in the bill payer app.

- When your check is direct deposited auto deduct even a small amount to a savings account. Pick a set amount to save even $20 at a time can add up. Keep yourself motivated not to touch it by setting a goal to save or a small wish list purchase once you attain the goal.

- Does your company offer a 401k match? Make sure you are maximizing your contributions to get the full amount of that “free” money in your retirement fund.

- Most Americans don’t have any type of emergency fund. Let’s face it, emergencies happen (car/home repair, unexpected bill or illness) and usually at the worst possible time. Having some cash set aside can really make this process much less stressful. As with step 7 auto deduct this out of each check into an account. Set a goal in your budget and replenish if you need to use these funds to cover an emergency.

- Acorns App – spare change investing. The average person at best has retirement investments. The concept behind this round up investing is that for every purchase you make you will “round up” to the next dollar and invest the spare change. This can add up over weeks, months or years of investing. Even though I have a background in accounting, I don’t have any investments outside my 401K. So to me this was a smart, fast and easy way to start without really carving anything extra out of my budget. If you want to try Acorns, get $5 when you use my invite link.

Hope you find these tips helpful. How do you keep your financial life uncluttered?

Saving Money

15 Things I don’t buy anymore – minimalism and money savings made easy

1.Subscription services/gym memberships – if you actually use your gym membership then by all means you should keep it. Review your cost though and compare. You can easily find something with just access to the machines for $15/month. Review all your monthly services – are you using them? You’d be surprised how many people pay for things they aren’t using.

2.Latest gadgets – Do you get a new phone every year? This also leads to a new case/screen protector because they never fit. Do you really need that latest cooking gadget? With every purchase I ask myself “will I really use it?”

3.New cloths – first I no longer shop for cloths without a list. Then I try to buy second hand high quality items over inexpensive new ones. Capsule wardrobes help you limit items in your closet while maximizing your daily outfits. I am not saying never to new but I try alternatives first.

4.Plastic sandwich bags – I replaced these with plastic sandwich containers that can be washed and re-used and protect a sandwich from being crushed. Not to mention can store items other than sandwiches.

5.Napkins – I got several packs of facecloths from Target. They are inexpensive – about the same size and can be easily washed and re-used.

6.Dryer sheets – I switched to wool dryer balls. If you want scents in the dryer just add a couple of drops of essential oil on your dryer balls. I prefer the ones made from wool.

7. Water bottles – better for both your wallet and the environment. Use re-fillable and washable water containers.

8. Coffee Shop Coffee –all your coffee purchases over a month will really add up. If you are a daily purchaser maybe do it once a week as a treat. We got a Keurig machine for home. This satisfied everyone in my household.

9. Books – unless I need it for reference in the future I read on my kindle and no longer purchase physical books. This saves money (kindle are usually less expensive) and the clutter.

10. Magazines – I enjoy a few magazines but I now get them delivered electronically vs paper. Magazines especially tend to be tossed after we read. Reading electronically will save trees, money and space.

11. Occasion clothing – ie. Shoes for one outfit or formal wear. I have one basic black formal wear dress. If I really need something for a special occasion I shop in a second hand shop then re-sell after I use it. I won’t buy shoes that work with only one outfit.

12. Disposable dishes/flatware – Even when I brown bag food from home for lunches I use real washable flatware and plastic re-usable dishes and containers. Don’t trust kids with your set of flatware/dishes from home? Pick up some odds and ends at a thrift store. These can be easily sterilized in your dishwasher.

13. Takeout/Fast Food – It’s not that I never get takeout or fast food but the goal is to drastically reduce it. We instituted make pizza night at home where we make pizza from supermarket pizza dough bought fresh (easy to freeze). Going out for the day? We pack lunches and/or snacks for on the go eating. This is much healthier and cheaper than eating out. Driving kids to practice with no time to eat yourself? Bring something from home to eat while you wait.

14. Cable – Figure out what stations you watch. With smart TV’s and Roku sticks as long as you have internet service you can stream almost anything. May services like Hulu and Netflix are reasonable and if you already have Amazon prime they have lots of free content (movies and shows) for their customers. Not ready to cut the cord? Look at what you are really paying for – could you save by buying your own modem? Do you watch those movie channels you pay extra for? Take a good look at your bill.

15. Labor – Many basic repairs/tasks can be done yourself vs paying someone to do them. With most appliance repairs I will google first. I have been able to save myself repair costs several times doing this. Repainting? You can do it yourself for a fraction of the cost. Look at what you are spending and see where it makes sense to cut back.

-

Gratitude4 years ago

Gratitude4 years ago12 Ways to Feel Gratitude during a Pandemic

-

Journaling4 years ago

Journaling4 years agoPhoto Journaling Documenting Your Memories

-

Gratitude5 years ago

Gratitude5 years agoHow to Start a Gratitude Journal You Can Stick With

-

Healthy Living3 years ago

Healthy Living3 years agoHow to Choose a Collagen Product

-

Journaling5 years ago

Journaling5 years agoCreating a Jar of Gratitude Prompts

-

Gratitude5 years ago

Gratitude5 years agoBeing Grateful while Social Distancing